- HOME

- Taxes & compliance

- What is Reverse Charge in VAT in Saudi Arabia?

What is Reverse Charge in VAT in Saudi Arabia?

What is reverse charge?

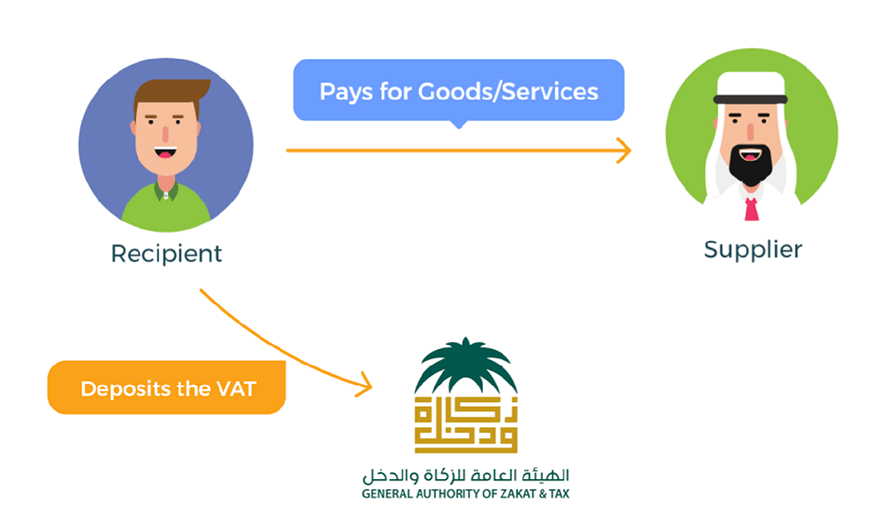

Typically, the supplier supplies goods/services and collects VAT on behalf of their customers, which is later paid to the government. Under the reverse charge mechanism, the end consumer pays the tax directly to the government.

The buyer will have to record VAT on purchases (input VAT) and sales (output VAT) in their VAT return for each month or quarter (based on their annual threshold). The VAT accounted by a buyer will be deductible as input VAT on the same VAT return.

When is reverse charge applied?

The reverse charge mechanism will be applicable in the following situations:

- When a VAT-registered business imports a taxable service

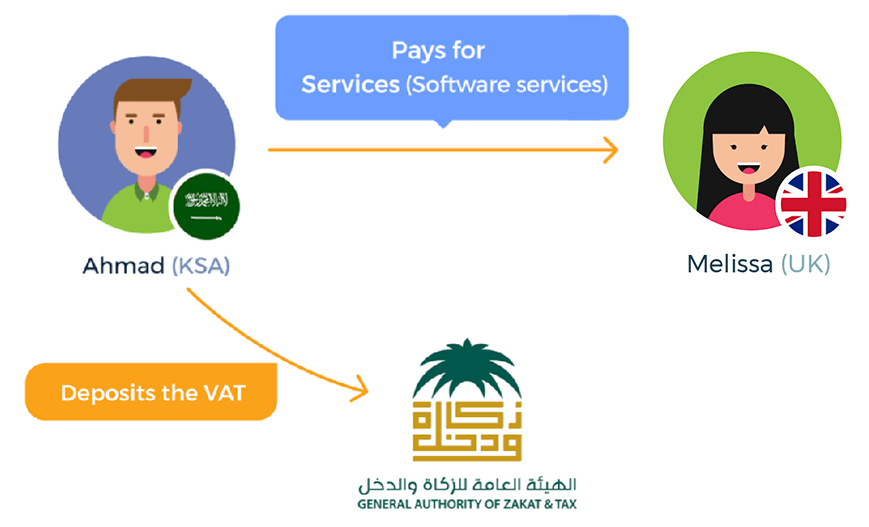

Unlike imported goods, imported services do not go through the Customs Department, so VAT cannot be collected at an airport or a border. Hence, the buyer accounts for input VAT on the transaction using the reverse charge mechanism. To understand the mechanism better, let’s look at an example using an imported service:

Ahmad owns a VAT-registered electronics store in Saudi Arabia. Ahmad’s store uses a software subscription from a UK-based firm owned by Melissa. Since the software is delivered electronically, it never goes through the Customs Department.

Melissa is not registered in Saudi Arabia, so she does not have to file any VAT returns or pay KSA tax. However, Ahmad is a KSA taxpayer and has acquired services from a non-KSA-based software store, so he must record the reverse charge for the transaction on his relevant VAT return.

- When a taxable person receives services from a non-resident

In this case, the taxable person must calculate the amount of VAT due by the reverse charge mechanism.

- When the trading occurs within the GCC

When trade takes place between GCC states, the supplier is not required to register in the destination country or charge VAT. So the buyer needs to account for the VAT under the reverse charge mechanism.

Why is there a need for the reverse charge mechanism?

The reverse charge mechanism is necessary to apply the domestic tax rate on overseas purchases. This is intended to remove any financial advantage of buying services from overseas compared to domestic purchases.

Industry-specific scenarios

Online services

Online services are taxable under the VAT regime. If the recipient of the services is a taxable person, they should pay tax on a reverse charge basis.

If the service provider happens to be a non-resident, they should appoint a representative within the Kingdom, and register for VAT, if their value of sales in KSA is more than 375,000 SAR.

Real estate

If a VAT-registered person in KSA receives a supply from a non-resident supplier, the supplier is not entitled to charge VAT on the supply. Instead, the recipient should report VAT on their VAT return under the reverse charge mechanism.

The non-resident supplier need not register under the VAT regime to report such supplies, nor do they need to issue VAT compliant tax invoices.

Example: Home LLC, a Qatar-based real estate firm, is charging La Maison WLL, a KSA-based firm, for providing painting and re-structuring services to La Maison’s commercial premises in Jeddah. In this example, Home LLC is a non-residential supplier and La Maison WLL is registered for VAT in KSA. So, it will be the responsibility of La Maison WLL to report VAT on this supply of services.